Mobile – contract: Depending on how much you use your mobile and what for, a contract with a UK-based mobile phone provider could be cheaper.Pre-paid SIM cards are widely available from UK shops and supermarkets, as well as from mobile phone providers Mobile – prepaid: gives you control over how much you spend and you can stop using whenever you want.You might be able to get a better deal by bundling your landline with Internet access, or you might choose not to have a landline at all and stick with your mobile Landline: usually only relevant if you live off campus.

When it comes to phones, you have three main options: You’ll probably want to get your phone and Internet sorted pretty quickly after arriving in the UK. Getting your phone and internet organised

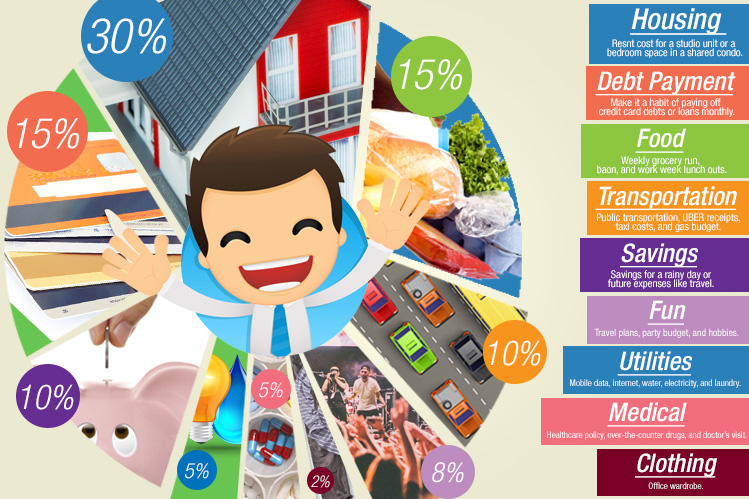

In the UK, you generally pay (and are paid) in pounds and pence. One option is Expatistan, which calculates the cost of living in the UK using up-to-date, crowd-sourced data. There are some handy websites you can use to help budget for your time in the UK. These figures do not include the cost of your study or tuition fees. £1,015 per month if you live outside London for the majority of your study (more than 50 percent of study time).£1,265 per month if you live in London for the majority (more than 50 percent) of your study.The UK Government suggests you will need around: Knowing how much you need for living expenses is a great starting point, but keep in mind the cost of living may be higher or lower depending on where you live. You want to enjoy a healthy and happy study life in the UK.

0 kommentar(er)

0 kommentar(er)